How is Big Data Reshaping the Commercial Real Estate Industry

TL;DR

- Explore how big data enables precise market trend analysis and property valuation.

- It discusses the role of real-time data in improving decision-making for property management.

- Examines the use of predictive analytics in identifying future opportunities and risks in the real estate market.

Big data is helping real estate organizations improve efficiency, cut costs, and make decisions, allowing them to become more adaptable to improve customer satisfaction and experiences. Unlike previous approaches, real estate businesses can now receive real-time data from big data. This data enables realtors, buyers, and investors to assess risks and uncover great opportunities. Based on the latest research by Markets and Markets, Big Data Market will be worth $273.4 billion by 2026. Big data in the real estate sector helps customers get their desired homes, the type of bedroom they need, and the right neighborhood in any region without visiting the location for assessment. It also optimizes consumer search and provides recommendations of reputable real estate websites to potential sellers and buyers.

Few examples of how big data helps Commercial Real Estate Firms and professionals?

- Using historical data, real estate companies can estimate project costs and construction schedule delays.

- Mortgage underwriters can reduce risk by measuring borrowers’ credibility in better ways.

- Property management companies can improve the effectiveness of building systems while lowering operational costs.

- Acquisition possibilities that both institutional and individual investors can find best suit an investor’s investing strategy.

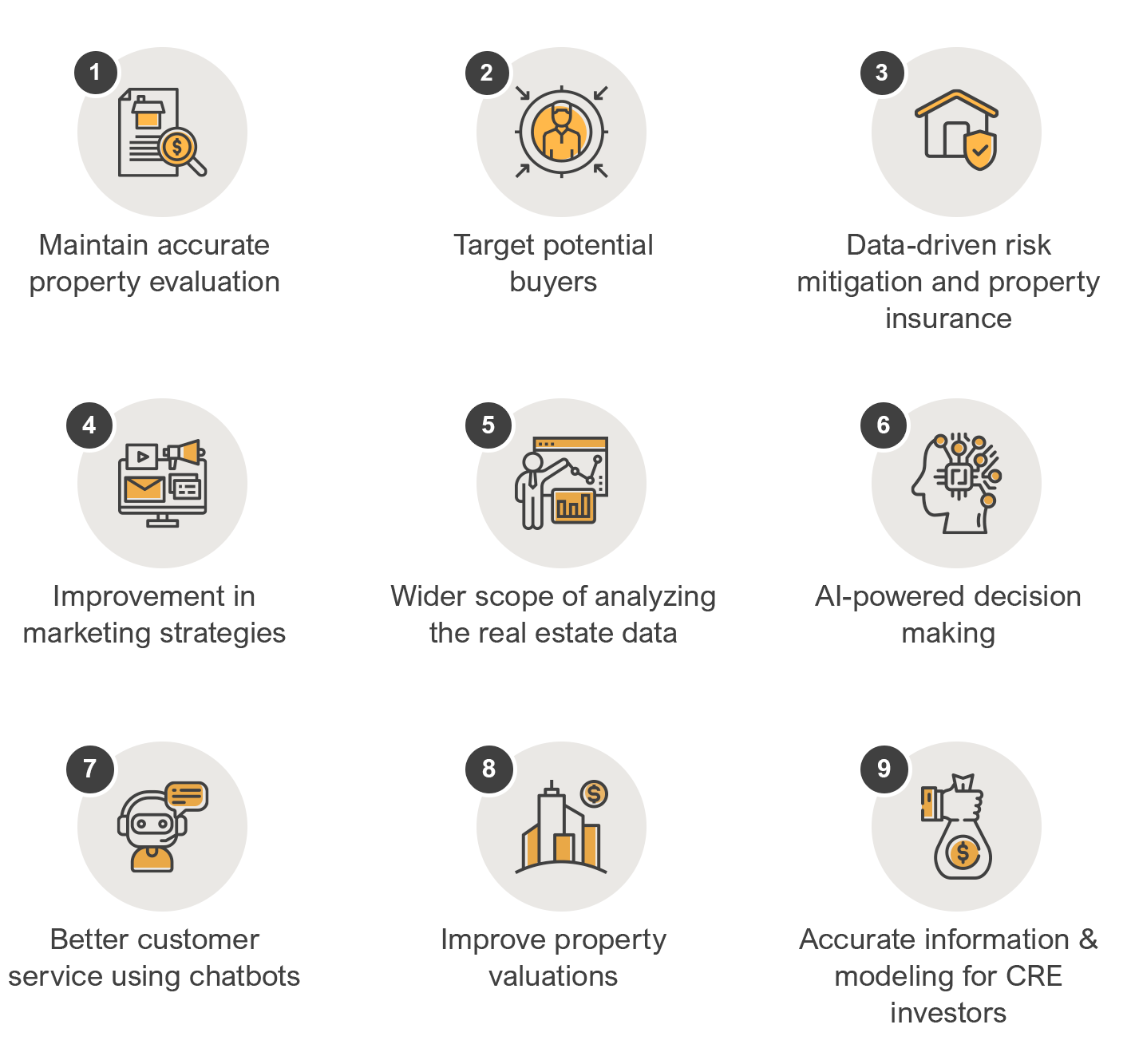

9 Ways Big Data is Transforming the Real Estate Industry

1. Maintain accurate property evaluation: Real estate organizations can use big data to enable automated assessment methods that will replace the traditional real estate appraisal, which has a high error rate. A big data model employs the most recent economic, demographic, and geographic data to eliminate human errors during property evaluation. Although humans cannot be replaced, big data algorithms use more data points to make better conclusions while boosting accuracy.

2. Target potential buyers: Thanks to big data solutions, real estate agents are no longer forced to make blind projections because they can now monitor and forecast customer behavior. They aid in identifying the requirements of potential buyers, making it simpler for the agents to identify and connect with their target audience. This strategy excels in luxury homes where customers aren’t looking in a specific location but rather for homes with high-end features. Using data analytics, real estate companies can provide potential homes tailored to these buyers’ tastes, preferences, and expectations.

3. Data-driven risk mitigation and property insurance: Obtaining accurate and clean data sets is also important when developing predictive analyses of the financial risks of investing in specific buildings and projects. Furthermore, big data analytics can assist insurance companies in providing the right insurance to prospective buyers or homeowners and actuaries in making better assessments. Also, Real estate firms can use data more precisely to determine a property’s condition and age and obtain reliable data on its redesigns and renovations.

4. Improvement in marketing strategies: Private and public data sources, business surveys, and social media provide insights that help determine the best market for a real estate project. Big Data analytics, for example, can provide real estate businesses with the data they require by sorting gender, age, preference, interests, and region. This will eventually improve specific firms’ marketing interactions. This information can assist real estate firms in identifying the needs of their ideal customers, such as homes or pet-friendly properties in excellent school districts. Whatever the ideal client’s requirements are, big data enables real estate firms to improve their marketing strategies to win real estate marketing revenue.

5. Wider scope of analyzing the real estate data: There are now more applications for big data in real estate, improving the accuracy of predictive algorithms and driving analysis for real estate development. For example, Big data analytics can aid in assessing the state of the mortgage industry, assessing insurance risk, performing actuarial calculations, and determining the purchasing power of median household incomes based on geography and other variables.

6. AI-powered decision making: Big Data is strongly intertwined with artificial intelligence, particularly machine learning. And machine learning with Big Data promotes transparency in real estate business processes, and ML algorithms can process massive amounts of data in a short period. A corporation wishes to add a new retail property to its portfolio. Big data can reveal demographic areas suitable for growth and renters. Predictive modeling based on expected property appreciation, construction costs, capital outlay, and marketing costs can assist you in determining the financial burden of a potential investment.

7. Better customer service using chatbots: Big data constantly changes customer service. Chatbots make heavy use of big data technology. It will gather customer information about what they need and send it to the agents so they can help the customers even more. Additionally, it stores customer data for future use and helps in lead generation.

8. Improve property valuations: Pricing for real estate can make or break its success, particularly when first introduced to the market. Big data provides insights into a wide range of similar real estate properties. To estimate property prices more precisely, you may use these insights to analyze market circumstances, buyer personas, and other data sets. Monitoring demographic and employment developments can assist your real estate marketing team to predict consumer behavior because data analytics is predictive.

9. Accurate information & modeling for CRE investors: Investors can base their decisions about commercial buildings on specific data such as rental rates, vacancy rates, energy, and other maintenance costs, as well as more general trend data about employment and consumer behavior. Data can be used to create 3D models that assist investors and developers in making the best use of available space.

Conclusion

What does big data mean for the future of real estate? Technological developments will cause the industry to change, resulting in more tailored customer experiences. These modifications will probably change roles, prerequisite knowledge, risks, and margins in the real estate industry. On the other hand, the future of big data and analysis in the real estate industry looks bright. Business professionals must acquire the analytical abilities necessary to make data-driven decisions to position themselves for the future real estate market. Are you a realtor who is keen to explore more about big data and looking to turn your Real estate data into an insightful solution to achieve productivity and improve profits? Talk to our experts today.

Saikiran Bellamkonda is Marketing Manager at Anblicks, responsible for overseeing GTM strategies, growth marketing, corporate marketing, strategic alliances, and marketing operations globally. He is deeply passionate about leveraging data-driven insights and exploring the transformative impact of AI on traditional business processes. Saikiran actively experiments with marketing technologies to drive added value and efficiencies. He holds an MBA degree with a focus in Marketing. Outside of work, Saikiran is an avid traveler and fitness enthusiast.