Lending AI

Intelligent

Lending Solution for the Digital Age

Credit Risk and Predictive Lending Analytics solution

LendingAI, is an advanced credit Risk and Predictive Lending Analytics solution built on the Snowflake platform.This solution leverages Snowflake’s capabilities for real-time credit risk scoring. It helps to reduce the approval times for loan applications and enhance financial industry’s ability to identify and manage risky customers using cutting-edge ML methods.

Reduced business risk with AI-based risk scoring systems

Increase in demand forecasting accuracy

Decrease in operational expenses

Increase in loan approval accuracy

Increase in effective marketing campaign

High Default Rates

LendingAI uses machine learning to assess credit risk in real-time, identifying high-risk borrowers effectively.

Customer Churn

Predicts churn patterns, helping retain valuable customers with proactive strategies.

Costly Marketing

Enables personalized marketing with customer segmentation, reducing expenses and improving sales.

Why LendingAI?

Real-Time Credit Risk Scoring

Utilizes advanced machine learning to assess credit risk instantly, enabling quicker and more informed loan decisions.

Churn and Defaulter Prediction

Accurately forecasts customer churn and potential defaulters, allowing proactive measures to retain clients and mitigate risks.

Personalized Recommendations

Provides tailored product suggestions based on individual customer profiles, enhancing opportunities for upselling and cross-selling.

Automation and Scalability

Offers APIs and rule-based workflows for automating loan servicing processes, improving operational efficiency and scalability.

Our Approach

Advanced Machine Learning Integration

Employs sophisticated machine learning techniques to enhance credit risk assessment and predictive lending analytics.

Real-Time Credit Risk Scoring

Leverages the Snowflake platform's capabilities to provide immediate credit risk evaluations, facilitating faster loan approval processes.

Comprehensive Risk Management

Utilizes predictive analytics to identify and manage high-risk customers, thereby reducing potential defaults and financial losses.

Customer Retention Strategies

Incorporates churn prediction models to understand customer attrition patterns, enabling the development of effective retention initiatives.

Personalized Marketing and Sales

Delivers tailored product recommendations and segmentation to boost targeted sales.

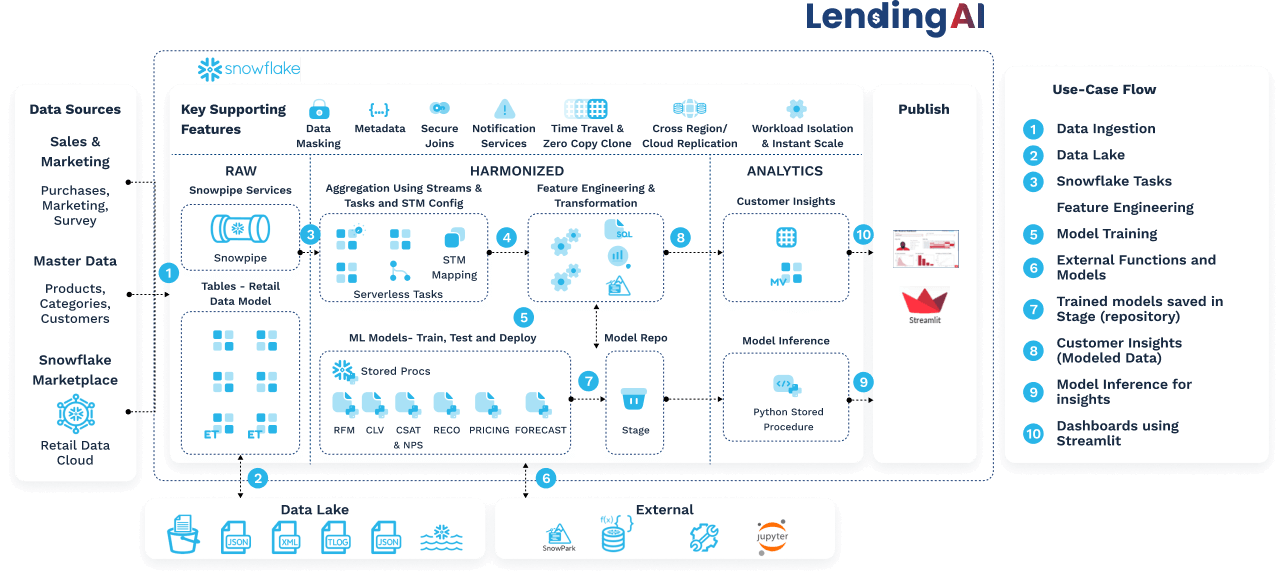

Solution Architecture

Our team used to spend hours analyzing data for loan approvals. Now, decisions that took days are done in moments. It’s faster for customers and more accurate for us. What stands out most is how easy it was to integrate this into our existing workflows.

VP of Lending

A Multinational Bank

As someone who works closely with clients on financing, I’ve always wished for a way to make approvals faster and less stressful. This platform has been a game-changer. It’s streamlined our entire process, and my clients love how quickly we can now give them answers.

CEO

Leading Real Estate Finance Company

Trusted by

Experience the Power of Real-Time Credit Risk Scoring

Explore how LendingAI’s predictive analytics can help you identify and manage risky customers.